ATTENTION: THIS WEBSITE IS UNDER CONSTRUCTION, REAL ESTATE LICENCE UNDER REGISTRATION PROCESS!

Buyers Frequently Asked Questions – France

Buying property in France is very different from buying real estate in North America. There is no centralized MLS, buyer representation is not standard, and the process is governed by strict legal steps handled by a notaire.

This FAQ is designed for English-speaking and international buyers — especially Americans relocating or retiring in France — who want clear, reliable answers. With buyer-only guidance, SHOKO helps you understand the French system, avoid common pitfalls, and move forward with confidence at every stage of your purchase.

Why Buying Property in France Is a Smart Long-Term Investment

Buying property in France is not only a lifestyle decision but also a long-term financial strategy. Historically, French real estate has shown steady appreciation, particularly in desirable cities, regions, and lifestyle destinations. While annual growth varies by location, well-chosen properties tend to retain and increase their value over time.

Unlike renting, purchasing allows you to build equity while securing a tangible asset in one of the world’s most stable real estate markets. Whether you plan to live in the property, use it as a second home, or hold it as an investment, ownership provides both security and potential capital growth.

Stable Housing Costs and Property Ownership in France

When you rent in France, rent increases and limited control over the property are common concerns. Buying, on the other hand, provides stability. With a fixed or structured mortgage, your housing costs are more predictable, allowing for better long-term financial planning.

Beyond stability, ownership means your monthly payments contribute toward an asset you control. Rather than paying rent indefinitely, you are investing in your own property while benefiting from potential appreciation over time.

Property Ownership in France as a Form of Forced Savings

Buying property in France acts as a form of forced savings. Each mortgage payment gradually increases your equity, while long-term market appreciation strengthens your overall financial position.

For many buyers, this structured approach to saving is more effective than relying solely on traditional savings or investments. Over time, property ownership has proven to be one of the most reliable wealth-building tools available.

Freedom, Customization, & Lifestyle Benefits of Owning Property in France

Owning a home in France offers freedom that renting simply cannot provide. From renovations to interior design choices, ownership allows you to create a space that reflects your lifestyle without landlord restrictions.

Whether you are purchasing a city apartment, a countryside home, or a coastal retreat, property ownership gives you control, comfort, and the ability to enhance value through thoughtful improvements.

Understanding the True Costs of Buying Property in France

Buying property in France involves both one-time acquisition costs and ongoing expenses. In addition to the purchase price, buyers should plan for notary fees, registration taxes, legal costs, and potential mortgage-related expenses.

Ongoing costs may include property taxes (taxe foncière), insurance, maintenance, condominium charges (if applicable), and utilities. Understanding these costs upfront ensures a smooth and well-planned purchase.

Why Mortgage Pre-Approval Matters When Buying in France

Securing mortgage pre-approval before beginning your property search in France provides clarity and credibility. It allows you to define a realistic budget and strengthens your position when making an offer.

French lenders evaluate income, residency status, and financial stability. Working with experienced mortgage professionals ensures your financing aligns with French lending requirements and timelines.

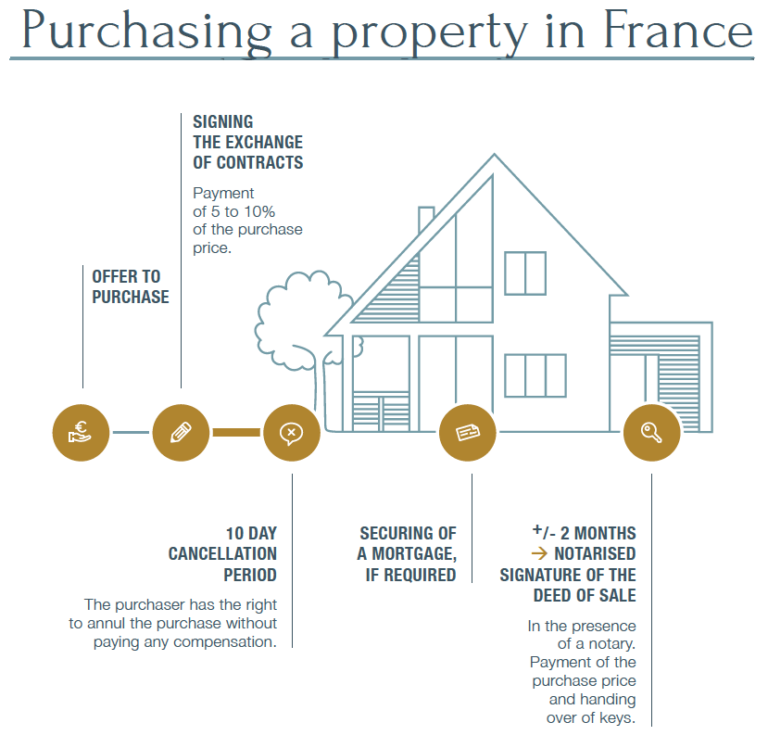

How to Make an Offer on Property in France

Making an offer in France is a formal legal step. Once an offer is accepted, the process moves toward signing the Compromis de Vente. Offers may include conditions such as financing approval or inspections.

Understanding timing, negotiation strategy, and legal obligations is essential. Professional guidance ensures your offer aligns with French law while protecting your interests.

SHOKO at EXPERTIMO delivers buyer-only real estate guidance in France, combining local expertise, trusted nationwide agencies, and a North American approach to clarity, strategy, and long-term value.

The Role of Notaries and Legal Professionals in France

In France, notaries play a central role in property transactions. They ensure legal compliance, manage funds, and register ownership with the state. Buyers benefit from a neutral and regulated legal framework.

Having independent guidance alongside the notary helps buyers fully understand documentation, timelines, and financial commitments.

Property Inspections in France — What American Buyers Should Know

In France, property inspections are handled differently than in the United States or Canada. Rather than a single general home inspection, sellers are legally required to provide a series of mandatory diagnostic reports (Dossiers de Diagnostic Technique – DDT).

These diagnostics cover key elements such as energy performance (DPE), electrical and gas safety, asbestos, lead exposure, natural risks, and wastewater systems. They are prepared by certified professionals and must be disclosed to buyers before signing the Compromis de Vente.

While France does not typically rely on a North American–style full home inspection, many American buyers—especially retirees—choose to commission an independent building inspection or technical review for added peace of mind. This is particularly recommended for older homes, rural properties, or renovation projects.

Understanding how French inspections work ensures transparency, helps avoid surprises, and allows buyers to move forward with confidence.

Home Insurance in France — Protecting Your Property and Investment

Home insurance (assurance habitation) is an essential part of property ownership in France. While not always legally mandatory for owners of single-family homes, it is strongly recommended and required by lenders when financing is involved.

French home insurance typically covers the structure, personal belongings, liability, and risks such as fire, water damage, theft, and natural events. For apartment owners, insurance is mandatory and must meet minimum legal coverage requirements set by the building.

For American retirees moving to France, selecting the right policy ensures your property and assets are protected under French law. Policies are generally affordable and tailored to property type, location, and occupancy status (primary residence, second home, or rental).

Working with a knowledgeable advisor helps international buyers secure appropriate coverage and avoid gaps between North American and French insurance expectations.

Mortgage Insurance and Income Protection in France

In France, mortgage life insurance (assurance emprunteur) plays a critical role when financing property. Unlike in North America, this insurance is usually mandatory and protects both the lender and the borrower.

Mortgage insurance typically covers death and disability and can be tailored based on age, health, and residency status. American buyers often have the option to choose an external insurer rather than the bank’s default policy, which can significantly reduce costs.

For retirees purchasing with or without financing, understanding insurance obligations ensures compliance with French lending standards while safeguarding long-term financial stability.

Peace of Mind for American Retirees Buying Property in France

Relocating or retiring in France is a major life decision. Understanding inspections, insurance, and legal protections allows American buyers to purchase with confidence and clarity.

With the right guidance, France offers a secure, transparent, and well-regulated property market—ideal for long-term living, retirement, or lifestyle investment.

Buying property in France with resale value considerations

When buying property in France, it’s important to think beyond today’s lifestyle and consider how the home will perform on resale. Even if you plan to live in the property long term, marketability remains a key factor in protecting your investment.

Resale value in France is strongly influenced by location, property type, layout, energy performance (DPE rating), and proximity to amenities. Apartments in well-managed co-ownership buildings and homes in desirable neighborhoods tend to retain value more consistently.

By understanding local demand and future buyer expectations, you can make informed choices that support long-term value while still enjoying your property today.

Choosing the Right Community in France

Selecting the right community is one of the most important decisions when buying property in France. Your choice affects not only daily lifestyle but also long-term property desirability and resale appeal.

Communities with strong local economies, cultural life, healthcare access, and public services tend to attract consistent demand. For international buyers, towns with good infrastructure and international appeal often provide greater long-term stability.

Whether you prefer an urban center like Strasbourg, a charming village, or a growing regional hub, community selection plays a critical role in your overall experience as a homeowner in France.

Neighborhood Accessibility & Transportation

Accessibility and transportation are major factors in property value and daily comfort in France. Neighborhoods with reliable public transportation, walkable streets, and nearby services are consistently in higher demand.

France’s extensive tram, bus, and rail networks make it possible to live comfortably without relying on a car, particularly in cities like Strasbourg. Easy access to shops, healthcare, schools, and cultural venues adds lasting appeal.

For buyers thinking long term, transportation access supports both quality of life and resale value, making it an essential consideration during the purchase process.